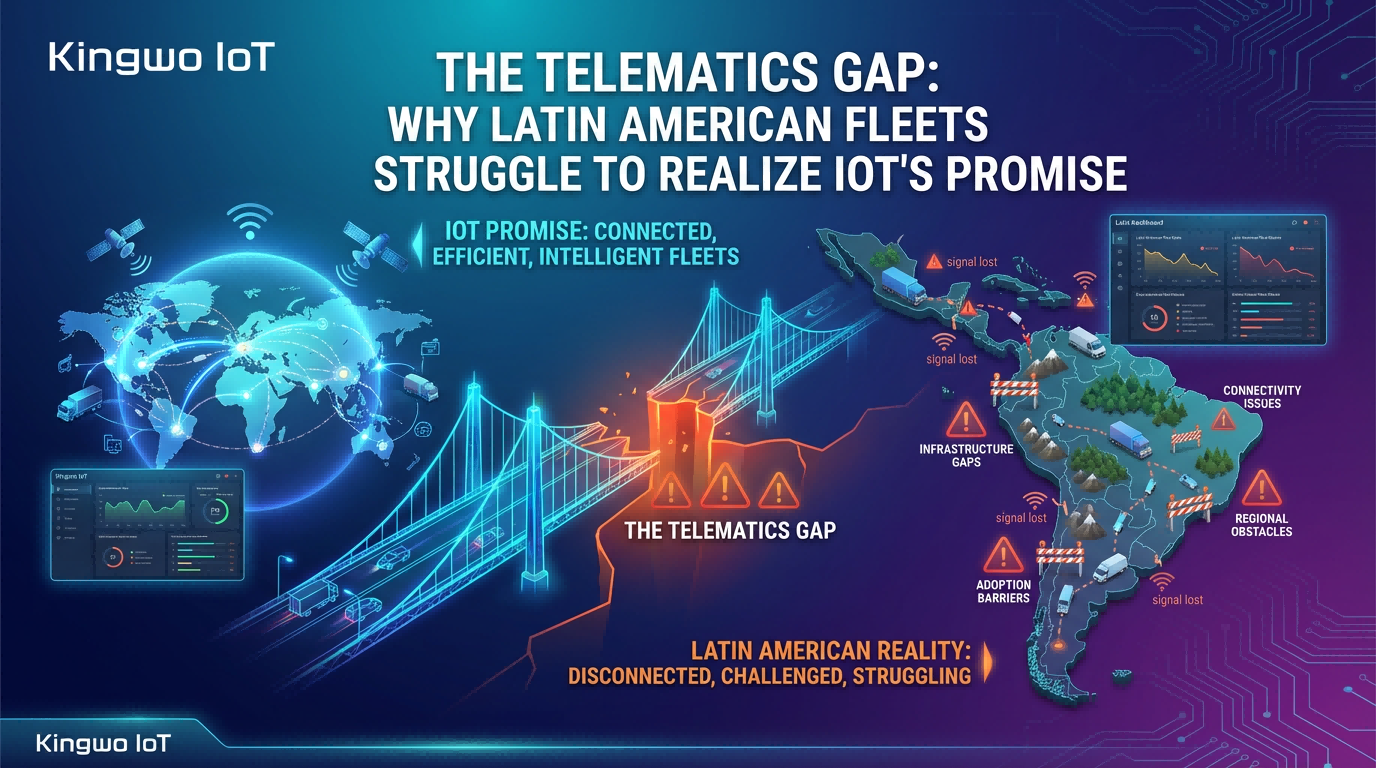

In theory, vehicle telematics should be a game-changer for fleet logistics: real-time GPS tracking, driver-behavior alerts, preventive maintenance warnings and rich analytics all promise to cut costs and raise service levels. Executives expect these systems to pay for themselves in fuel savings, safety gains and uptime. In practice, however, many Latin American fleets report disappointing results. Adoption in the region remains low – less than 20% of vehicles use telematics today – and even where systems are deployed they often under-deliver. The problem isn’t bad hardware. As one industry analyst observes, “This isn’t a technology problem. The hardware works. The data exists.” Instead, the root causes lie in people, processes and organizational design.

Several systemic issues quietly sap telematics programs of value. Data and systems tend to be fragmented, goals are unclear or short-term, and nobody takes full ownership of the outcome. Drivers and managers may distrust or ignore the new tools. In the end, fleets end up with mountains of raw data but few actionable insights. This analysis explores those underlying gaps – poor integration across systems, pilot-minded rollouts, misaligned incentives, and misreading field realities – that cause telematics projects to stall. By understanding these pitfalls, fleet leaders can recognize the same patterns in their operations and take steps to fix them.

A common problem is integration. Many fleets end up running telematics as yet another standalone platform, separate from dispatch software (TMS), maintenance systems, payroll systems and others. Each solution might produce useful data (vehicle location, fuel use, driver hours) but if those streams don’t flow seamlessly into core business systems, the value is muted. In fact, experts note that “poor integration quietly drives inefficiency, increases operational risk, [and] frustrates frontline teams,” because disconnected IT systems force extra work and bottlenecks. In one recent survey, running separate location, fuel and safety tools in isolation was shown to inflate operating costs by 20–40% as administrators spent hours reconciling data between platforms.

This fragmentation creates silos of telematics data. For example, dispatchers may see GPS tracks but maintenance crews have no insight into actual engine warnings, and safety managers may not get fuel-use logs. Even worse, different departments collect telematics metrics but “none coordinate effectively.” In one case study from the insurance sector, each team (claims, underwriting, risk management) gathered telematics signals, yet they never communicated them. One department would process a crash without reviewing driver-speed data that another unit already had. In short, nobody took responsibility for joining the dots. The result in logistics: senior managers still rely on spreadsheet reports and radio check-ins rather than live dashboards, and decisions lag what the data should allow.

The impact is clear: rather than empowering smarter dispatch or maintenance planning, a siloed telematics tool simply becomes one more IT fragment. Fleet operators report endless manual cross-checking of GPS logs against fuel records and work orders, with still no unified “single source of truth.” Without integration, the promises of savings and efficiency remain theoretical, because operations cannot automatically act on the alerts and insights the telematics system generates.

Another key issue is mindset. Telematics projects often start as tech pilots or quick fixes rather than strategic overhauls. Management may buy a few devices, install them, and expect instant ROI. If hard results don’t emerge in weeks, budgets dry up. This short-term view sets teams up to fail. Telemetry can enable huge savings, but only if ambitions and timelines match reality. As one analysis warns, too many companies overlook the need for clear, upfront goals. Without well-defined targets – whether cutting idling by 10%, reducing accidents by 20%, or boosting vehicle utilization – there is no way to tell if the system is working. Indeed, “when there are no predetermined targets… it is impossible to establish whether the new efforts… are effective,” meaning success becomes a moving target.

When rollout is rushed, staff struggle to keep up. Installations may happen without communicating “the why” to dispatchers, drivers, or mechanics. Drivers may ignore alerts if they don’t see immediate benefit, and mechanics might not follow new maintenance prompts if no one holds them accountable. Conversely, setting unrealistic targets can backfire too – for example, expecting 100% adoption or overnight fuel savings can breed disillusionment when numbers fall short. Good practice is to pilot on a narrow use-case (say, one region or vehicle type), measure those KPIs rigorously, and then scale gradually. As one expert recommends, fleets should “start small” with one or two key metrics (such as preventable incidents or utilization) and prove value before expanding. In Latin America especially, this incremental approach can fit local contexts and budgets.

In essence, a telematics program needs a long-term perspective. It should be treated as a change-management initiative, not just a gadget installation. Fleet leaders must resist the “instantly paid for itself” narrative, and instead align telematics deployment with annual planning cycles. Building this alignment – setting realistic objectives, continuously monitoring pilots, and iterating on deployment plans – avoids the trap of branding telematics a failed experiment simply because early expectations were unmet.

Closely related is who owns the telematics initiative. Without a clear champion, projects drift. In some firms, telematics is treated as an “IT project” and forgotten once installed; in others it’s dumped on safety or logistics staff with no mandate to enforce it. The missing piece is usually an accountable team or leader who uses the data daily and feels its impact. When that doesn’t happen, the system becomes a shelfware.

For example, if nobody monitors the dashboard for speeding alerts, drivers learn to bypass or ignore the system. If mechanics aren’t required to act on engine warning notifications, trucks still break down. Successful programs typically have an operations manager or analyst whose job is to mine telematics data for actionable insights. When that role is absent, the technology yields little more than blinking warnings no one looks at. In interviews with fleet managers, a recurring refrain is that telematics “failed” not because of poor hardware but because the fleet never integrated the information into its day-to-day culture.

Driver buy-in is a crucial cultural factor. If drivers feel the system is a Big Brother, morale drops and data quality suffers. Conversely, if telematics is positioned as a tool to make their jobs easier or safer, acceptance improves. “Successfully adopting a fleet monitoring system hinges on driver acceptance,” emphasizes one telematics guide. Fleets that involve drivers early — showing them how scorecards and alerts can reward good performance and prevent accidents — see far smoother rollouts. Without this cultural alignment, management will have a hard time using the data. In short, telematics must become part of operations – included in daily meetings, wrapped into incentive programs, and championed by supervisors. Otherwise it remains a side project that fails to deliver change.

It is also common for telematics programs to assume ideal conditions on the ground that simply don’t exist. For instance, many systems rely on constant cellular connectivity, but in remote corners of Latin America signal can be spotty. When trucks pass into blackspots, the tracking device may store data for hours and only transmit later – which means real-time visibility is an over-promise. Similarly, simple metrics like fuel efficiency may be hard to correlate in regions where road quality, detours, or local driving customs dominate fuel burn.

Local context matters. High crime rates in some cities make fleet managers hesitate to share the keys with drivers, or to leave trucks parked overnight without armed security. This, in turn, affects how telematics should be used. For example, fleets in Latin America often prefer event-based tracking: systems trigger alerts only on specific events (theft alarm, collision warning, unscheduled idling) rather than continuously broadcasting location. This model addresses privacy concerns and cultural expectations – employees appreciate not being tracked 24/7, and managers still get notice of the critical moments. Analysts note that “privacy is the other pillar” in LATAM telematics. Adopting an “event-first” approach (hard braking, engine codes, etc.) “reduces friction with employees while preserving safety and efficiency gains”. Ignoring these ground realities (security, laws, road conditions) can render a technically sophisticated solution useless in practice.

Finally, basic training and support cannot be overlooked. Many fleets fail simply because staff (drivers, analysts, dispatchers) are not taught how to use the new tools. Installing a telematics box and shipping a login to a manager is not enough. Without hands-on training, people find ways to work around the system or ignore it entirely. Over time, the lack of support and constant pressure to deliver quick wins leads organizations to quietly abandon telematics initiatives as “worthless.” In truth, they under-delivered only because nobody learned how to unlock the value.

Even when data reaches the right place, fleets often drown in it. Modern telematics systems capture an avalanche of data points (speed, RPM, throttle position, fault codes, and more). Without smart filtering, decision-makers get buried in logs and notifications. One fleet manager described the situation as “a firehose of signals.” If every minor engine code triggers an alert, the noise drowns out the few truly actionable items. Operators then develop “alert fatigue” and stop trusting the system altogether.

To avoid this, successful fleets focus on use-cases. For example, if reducing downtime is the goal, telemetry should highlight only engine-fault patterns that reliably predict breakdowns. If safety is the priority, it should flag only the most dangerous driving events. In practice, data overload becomes a failure mode – too many dashboards, each irrelevant to a particular user. The fix is to streamline: set thresholds that make sense for your vehicles, suppress low-value signals, and tie metrics to concrete process changes. When done properly, telematics can be a catalyst for better maintenance schedules or safety coaching. But without that filtering, it’s just an expensive sensor farm with no clear output.

These lessons may sound like “common sense,” but experience shows they’re often overlooked in the rush to deploy new technology. The key is to treat telematics not as a plug-and-play gadget, but as an end-to-end program. In practical terms, fleets should:

In short, telematics must be seamlessly woven into the operational fabric, not grafted on top of it. When integration is done right and people are empowered, fleets begin to see the promised returns – fewer accidents, optimized fuel use, better customer service. Indeed, companies that adopt a careful, iterative approach typically see telematics ROI multiply year over year.

At Kingwo, we’ve seen these patterns play out in fleets across South America. That’s why our telematics platform is built from the ground up to address them. We emphasize interop and flexibility: our devices feed into an open data architecture so that GPS, fuel, and sensor data feed directly into your transport, maintenance and business systems. In practice this means managers get unified dashboards instead of disjointed reports. We also design for the local reality. Our Latin American deployments use “event-driven” tracking by default, alerting only on critical incidents to respect privacy and bandwidth. Clients can start with a pilot – say, monitoring preventive-maintenance codes on 10 trucks – and then scale up, knowing the platform will grow with them.

Just as importantly, Kingwo provides change-support. We work with each fleet to define success metrics up front and provide training so that drivers, dispatchers and mechanics all understand how to use the data. Our goal is to make telematics part of your team’s routine: an indispensable tool rather than a “nice-to-have” toy. By confronting the real obstacles – integration, ownership, cultural buy-in, and tailored design – Kingwo helps fleets finally turn connected-vehicle data into the efficiency, safety and cost-savings they were promised.

In the end, telematics is only as valuable as the decisions it enables. Recognizing the pitfalls above is the first step. The next step is to choose solutions and partners that build around these lessons. Only then can South American fleets truly capture the full power of their connected vehicles.

English

French

Portuguese

Spanish